Purchasing a new vehicle is always an exciting venture. Peoples Bank & Trust wants to help you maximize your buying experience with a strategic and helpful savings plan! Before you start roaming the car lots, glance at our easy auto check list to see what type of vehicle both you and your budget are searching for.

Determine if you want a new or used vehicle.

Many auto dealers today offer both new and used. While new can offer updated technology and the assurance of no prior owners, choosing a used vehicle can drastically diminish cost and offers a comparable quality with moderate mileage.

Decide on a budget and a timeline.

When choosing the right vehicle to purchase, there are many questions to help you research which option may be best on your pocket book in the long run.

-How long do you want to drive this vehicle?

-What does your budget allow you to spend for the down payment and installments?

-When do you need your vehicle by?

-What type of MPG do you need to keep gas costs within your overall budget?

-How long do you want to be paying the loan off?

With these questions in mind you can better view the credentials needed in the ideal vehicle for you and your family.

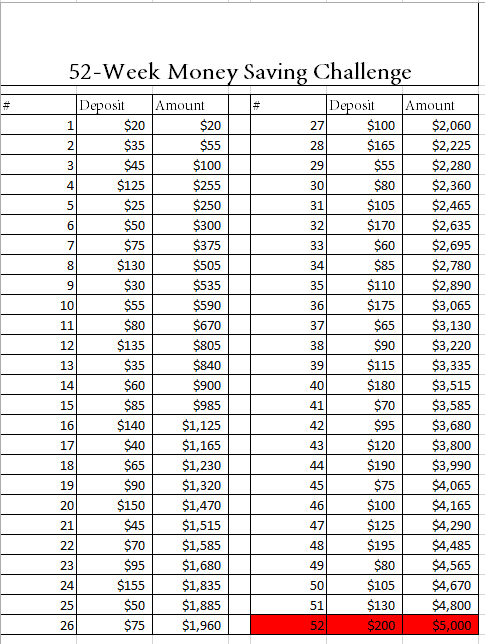

Do your part to save.

Once you have your budget set, it’s time to start saving! By putting aside a designated amount from each paycheck towards your new car, you can create a timeline for when you plan on purchasing it! In addition to these savings, cutting any additional spending can help you allocate more funds towards your new ride. Eating in more, buying generic, and carpooling to work are just a few ways to save some extra change.

Talk to us!

If you have questions regarding your savings plan stop by your nearest location today. We’re happy to help, and look forward to making your auto buying dreams a reality.

Peoples Bank & Trust Co.

Equal Housing Lender

Member FDIC